The Triangular Moving Average (also known as TMA) is a well-known technical indicator because of its capacity to provide more accurate information during a sharp movement of the market (like a bullish or bearish movement). Before we proceed, we want to mention the drawback of this indicator. It is better not to use in the ranging market because there are no sharp trends in those cases. An investor can identify the TMA easily because this average line is smoother than the Simple Moving Average (SMA).

How is TMA drawn and calculated?

To calculate TMA, the trading software determines the averages of the moving average at the beginning, which is also known as a Simple Moving Average. Different input information like volume of the trades, prices, peak value, and bottom value are used to calculate this. If you develop the price bars on the chart, you can easily determine what is going on in the market.

TMA is the average of SMA, which is the average of the end N prices (P). So, you have to determine the SMA value by the following equation,

Simple Moving Average (SMA) = Mean of the P (for N prices)

After obtaining each SMA value, use the equation to calculate the TMA value –

Triangular Moving Average (TMA) = Mean of the SMA (for N prices)

If you are worried about the data needed to calculate SMA or TMA, don’t worry because the platform will do it for you.

Many beginners are unable to find out about this indicator. In this case, firstly, they have to open their chart and search for the TMA in the “indicators” section. Even if you don’t find this, don’t worry. Apply the Moving Average value and then modify the formula and set the equation to calculate the TMA. Feel free to read more about the advanced indicator at Saxo. It will help you to develop your knowledge and boost your confidence.

How can you understand the entry/exit points or the trend type using TMA?

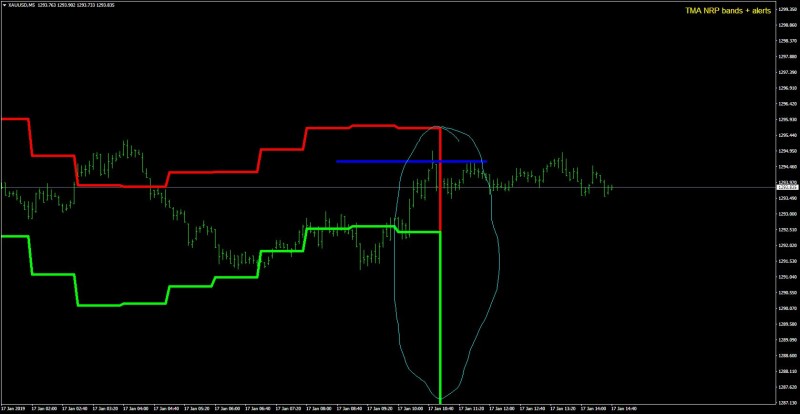

We have mentioned that the TMA works best during a sharp movement or the price. After using the TMA, you will see a smooth line and a Regular Moving Average line (also known as buzzer indicator).

Identifying from the graph/chart

During a downward movement, the TMA line will appear above the normal buzzer indicator. When these two lines crossover one another, then that will be regarded as the point to buy the currency.

So, buy the currencies at the point when the TMA (smoother line) goes beneath the buzzer indicator.

During the uptrend, the TMA line will appear below the buzzer indicator, and when the lines crossover one another, that will be your selling point.

Remember that the TMA line moves steadily and reacts slowly, and that’s why you have to think a bit earlier while predicting the movement using the TMA line.

Identifying from the bars/histograms

You may observe two different types – the green histogram and the coral histogram. In addition, there is a reference level that is called the signal, and Forex traders in Hong Kong have to use this level to enter or close their trades.

When the green histogram indicator starts moving above the reference level (0.00), you must understand that there is an uptrend in the market. Professionals recommend buying the currencies at the beginning of this graph. When the green histogram diminishes, and the coral histogram starts its journey below the reference level (0.0), it indicates that the investor must close his trade. The movement of the coral histogram suggests that the market is experiencing a downward movement.

Conclusion

Remember that the TMA indicator can be useful, especially in a trending market. However, this average line is smoother and moves steadily. Indeed, you can earn your profits quickly when the trend takes an upward movement, but as the line reacts slowly, you may have to think about closing the trade a bit earlier.